Our topics

Explore all our Generalist (EN) content

automotive

Cars, vehicles and driving

View articles →business

Business and economy

View articles →cooking

Recipes and culinary arts

View articles →finance & real estate

Finance, investment and property

View articles →health

Health, wellness and wellbeing

View articles →home & living

Home, decor and lifestyle

View articles →News

Latest news and current events

View articles →pets

Pets, animals and companions

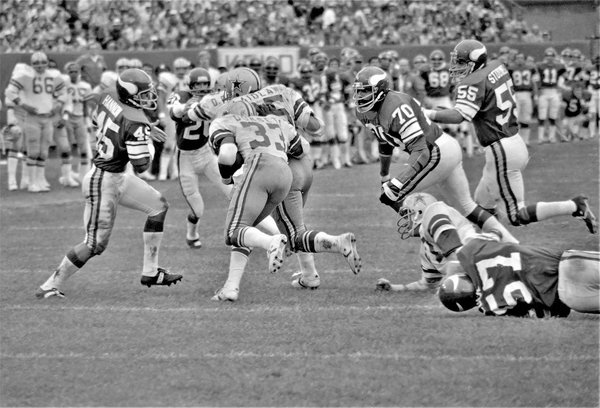

View articles →sports

Sports, fitness and competition

View articles →technology

Tech, gadgets and innovation

View articles →woman / fashion

Fashion, beauty and lifestyle

View articles →Latest articles

Our recent publications

Boosting Rowers' Endurance: Discover the Power of HIIT Workouts for Enhanced Aerobic Capacity

Endurance is the cornerstone of rowing performance, influencing how effectively a rower can maintain speed over long dis...

Revitalize Recovery: Electromagnetic Field Therapy's Impact on Athletic Fracture Healing

Electromagnetic Field Therapy (EMFT) is a healing modality that uses electromagnetic fields to influence cellular behavi...

Maximize Rowing Results: Expert Tips for Using Heart Rate Monitors to Track Workout Intensity

Heart rate monitors are vital tools for rowers aiming to enhance their rowing performance and track their workouts effec...

Discover the lasting advantages of routine vehicle maintenance for uk drivers

Routine vehicle maintenance is crucial for ensuring safety, enhancing performance, and securing long-term financial savi...

Exploring the distinctive hurdles faced by uk rural drivers compared to their urban counterparts

Rural driving in the UK presents unique challenges distinct from urban experiences. Rural driving obstacles arise from f...

Safe pet travel: uk vehicle guidelines for secure and happy journeys

Understanding UK pet travel regulations is crucial for pet owners who wish to travel with their furry companions. To sta...

How Are UK Businesses Adapting to Sustainability Initiatives?

Explore the evolving landscape of eco-conscious enterprise...

How can UK businesses adapt to changing consumer behaviors?

UK consumer trends reveal significant changes in shopping preferences, driven largely by post-pandemic consumer habits. ...

How Do UK Businesses Navigate International Trade Regulations?

Navigating international trade regulations in the UK demands a clear understanding of complex compliance requirements an...

How can you craft a delicious toad in the hole?

Understanding the foundation of a perfect toad in the hole...

What are the key ingredients for an authentic English breakfast?

An authentic English breakfast is defined by its classic breakfast foods, each bringing distinct texture and flavour. Th...

What are the secrets to crafting the perfect shepherd's pie?

Understanding the shepherd's pie basics starts with choosing the right core ingredients. Traditionally, lamb is the pref...

How do interest rates affect real estate market trends?

Understanding how interest rates influence the property market is key to making smarter real estate decisions. In 2024, ...

How do interest rates impact real estate prices?

In 2024, mortgage rates in the US averaged around 7.1%, marking a significant shift from recent years (Freddie Mac). Thi...

What are the tax implications of investing in real estate?

Diving into real estate can certainly grow your wealth, but it also introduces a maze of tax considerations. In 2024, UK...

Cultivating Emotional and Social Intelligence in Kids: The Power of Multicultural Exposure

Emotional Intelligence and Social Intelligence are pivotal parts of child development. These forms of intelligence perta...

Revitalizing your heart: how consistent sauna use boosts heart health and longevity

Cardiovascular health is crucial for ensuring a long and healthy life, and it encompasses the well-being of the heart an...

Revolutionizing Stroke Rehabilitation: How Haptic Technology Enhances Recovery Outcomes

Haptic technology refers to systems that simulate the touch and feel through mechanical or electronic means, providing f...

How Will Recent Political Changes Impact British Society?

Recent UK political developments have been marked by significant shifts in leadership and legislation. Notably, new UK l...

What are the challenges facing UK housing market today?

The UK housing market overview in 2024 illustrates a complex landscape influenced by multiple dynamic factors. Recent da...

What Challenges Are Currently Facing the UK?

The UK economy is grappling with significant economic challenges shaped largely by the ongoing cost of living crisis. A ...

How Can Pets Positively Influence Our Lives in the UK?

Pet ownership in the UK significantly encourages increased physical activity among owners. Walking a dog daily or playin...

How Can You Create the Perfect Environment for a Happy Pet in the UK?

Caring for pets in the UK requires a clear grasp of their specific needs, which vary significantly between pet types lik...

How Can You Ensure Your Pet's Happiness in a UK Home?

Creating pet happiness in UK homes depends heavily on consistent daily routines tailored to the unique needs of British ...

How are UK tech companies integrating blockchain technology?

Recent years have seen significant UK blockchain adoption within the UK tech sector, reflecting growing confidence in th...

What are the future prospects for UK tech exports?

Recent UK tech export statistics reveal a landscape of robust growth and evolving opportunities. The UK's technology ind...

What are the key challenges facing UK technology startups today?

Navigating the UK tech startup challenges requires a clear understanding of the evolving business climate in the UK. Fou...

How can you style vintage clothing for a modern look?

Blending vintage pieces with modern styles is more than a trend—it's a way to express unique personality and sustainabil...

What are the must-have accessories for women this season?

Accessories have always been the secret sauce to elevate any outfit, and this season is no exception. According to a 202...

What are the top fashion tips for petite women?

Dressing for a petite frame isn't just about fit—it's about embracing your unique silhouette with confidence. According ...